Hedge Fund Business Plan, Marketing Plan, How To Guide, and Funding Directory

The Hedge Fund Business Plan and Business Development toolkit features 18 different documents that you can use for capital raising or general business planning purposes. Our product line also features comprehensive information regarding to how to start a Hedge Fund business. All business planning packages come with easy-to-use instructions so that you can reduce the time needed to create a professional business plan and presentation.

Your Business Planning Package will be immediately emailed to you after you make your purchase.

- Bank/Investor Ready!

- Complete Industry Research

- 3 Year Excel Financial Model

- Business Plan (26 to 30 pages)

- Loan Amortization and ROI Tools

- Three SWOT Analysis Templates

- Easy to Use Instructions

- All Documents Delivered in Word, Excel, and PDF Format

- Meets SBA Requirements

Hedge funds often get a bad rap in terms of how they conduct their operations within the United States and abroad. However, hedge funds are provided very important function to the market given that they make sure that there is a tremendous amount of liquidity as it relates to the capital markets. For hedge fund managers, the fees that are associated with making ongoing and successful trades can provide the manager with a eight figure income. However, this is usually reserved for only the best performing hedge fund managers. Typically, most hedge funds manage somewhere in the neighborhood of $100 million to $500 million in their limited partnerships. Generally, much like venture capital firms and private equity firms, hedge funds usually take a fee of 1% to 2% of the underlying assets under management per year as well as a 20% success. There are some variations as to how incentive fees are calculated in the market.

A hedge fund business plan should focus substantially on the underlying costs associated with operating the business on a day-to-day basis. Most importantly, a well-developed profit and loss statement, cash analysis, talent sheet, breakeven analysis, and business ratio page should be developed in order to understand how much money needs to be kept on hand for success fees are paid. Typically, success fees are paid on a yearly basis and as such a hedge fund manager who is operating profitably must be able to carry their underlying expenses until the firm is able to receive these fees.

Much with other private investment vehicles, a hedge fund marketing plan needs to be developed in conjunction with an attorney who understands securities law. A hedge fund is not permitted to market their services to the general public. As such, many hedge fund managers have pre-existing relationships with people that they can contact to become potential investors and their firms. As such, most people that get into this industry usually have five years to 10 years of experience in corporate finance or insecurities trading.

A hedge fund SWOT analysis must be completed before an individual watches operations to determine whether or not there hedge fund is going to be economically viable. Most importantly as it relents relates to strengths, these businesses generate extremely high fees and extremely high gross margins from their services. However, an ongoing and successful track record is required in order to generate these fees. For weaknesses, competition within the hedge fund industry is significant. There are currently eight thousand registered private investment vehicles specialize in securities trading. For opportunities, most hedge fund managers will launch a number of different funds in order to maximize the amount of capital that they have under management. Pertaining to threats, or are ongoing regulatory considerations that must be taken into account as relates to the day-to-day operations of a hedge fund. It is imperative that these businesses retain an attorney as well as a CPA in order to make sure they operate within the letter of the law at all times.

Hedge Fund Business Plan

1.0 Executive Summary

The purpose of this business plan is to raise $10,000,000 for the development of a hedge fund while showcasing the expected financials and operations over the next three years. The Hedge Fund Inc. (“the Company”) is a New York based corporation that will provide investment management for its investors in its targeted market. The Company was founded by John Doe.

1.1 The Operations

The Hedge Fund will solicit capital from accredited investors (defined later) with the intent to use this capital to make investments marketable securities and other hedge funds. The Company expects to generate compounded annual returns of 25% to 35% per year on capital invested into the Hedge Fund’s portfolio holdings.

The Management of the Hedge Fund will retain a 20% ownership interest in the firm. Details of the fee arrangements for the Hedge Fund can be found in the Company’s private placement memorandum.

The third section of the business plan will further describe the investment management services offered by the Hedge Fund.

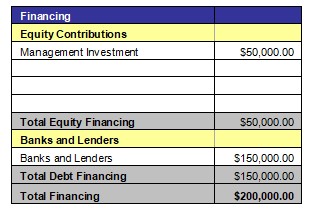

1.2 The Financing

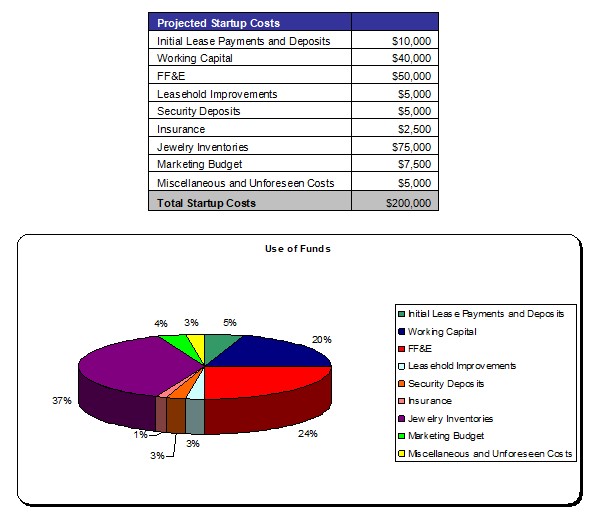

At this time, the Company is seeking to raise $10,000,000 for the development of the Hedge Fund’s operations. Mr. Doe is seeking to sell an 80% ownership interest in the business in exchange for this capital. 85% of the invested capital will be used for direct investments into the firm’s investments. Briefly, the capital will be used as follows:

- Acquisition of profitable investments and marketable securities.

- Development of the Company’s office.

- General working capital.

1.3 Mission Statement

Management’s mission is to develop the Hedge Fund into a large scale investment firm that that will provide dividend income, capital appreciation, and interest income to the Company’s investors and senior directors.

1.4 Management Team

The Company was founded by John Doe. Mr. Doe has more than 10 years of experience in the investment management industry. Through his expertise, he will be able to bring the operations of the business to profitability within its first year of operations.

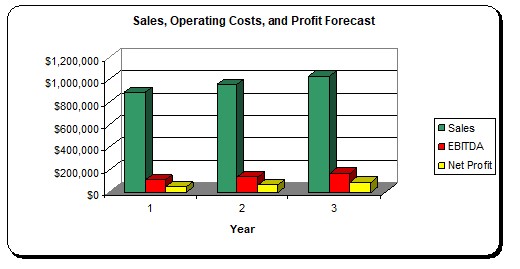

1.5 Revenue Forecasts

1.6 Expansion Plan

The Company will to undergo an aggressive expansion after the successful completion of the initial capital raising period. As the Hedge Fund is a multifaceted investment firm, Management will expand each segment of the business by developing limited partnerships that will attract additional capital for the Company’s marketable securities and fund of funds portfolios.

2.0 The Financing

2.1 Registered Name and Corporate Structure

Hedge Fund, Inc. The Company is registered as a corporation in the State of New York.

2.2 Use of Funds

2.3 Investor Equity

At this time, Mr. Doe is seeking to sell an 80% interest in the Hedge Fund in exchange for the capital sought in this business plan. Please reference the Company’s private placement memorandum regarding more information regarding the Company’s fee and ownership structure.

2.4 Management Equity

John Doe currently owns 100% of the Hedge Fund, Inc.

2.5 Exit Strategy

The exit strategy would be to sell the Company to a larger entity at a significant premium. Since, the financial management and hedge fund industry maintains a very low risk profile once the business is established; the Management feels that the Company could be sold for ten to fifteen times earnings.

3.0 Operations

Below is a description of the investment management services offered by the Hedge Fund.

3.1 Marketable Securities

Management will investments directly into marketable securities and other hedge funds that specialize in specific areas of trading. The Company intends to develop a number of trading strategies including options trading, LEAPs trading, long position/short position trading, and other methods of trading that will produce small but consistent gains on a weekly and monthly basis. The Hedge Fund may also engage a covered call strategy that would allow the fund to amply it return on investment for securities that are held for an extended period of time.

In regards to investing in other hedge funds, outsourcing trading activities is expensive as hedge funds charge large AUM fees and performance fees on their aggregate capital pools.

3.2 Mortgage Based Securities

As the Company expands, the Hedge Fund may become a syndicate and distributor of real estate limited partnerships based around prime mortgages. This would allow the Company to engage and extremely aggressive expansion.

In the event that the economy develops an unusually high prime interest rate, the Company may seek to act as a grantor of mortgages so that the Company can generate income on its unused cash. As such, in this event, the Hedge Fund can employ its cash reserves in the purchase of mortgages and associated debt instruments so that the business can earn additional streams of income from its monetary holdings. These mortgages can also be sold within the secondary market through the myriad of mortgage investment banks that have developed since the real estate boom. As the credit crisis has prompted a sharp drop off in the number of issued mortgages, Management sees a significant opportunity to acquire and trade distressed mortgage assets that could produce both capital appreciation and income for the Hedge Fund.

4.0 Market and Strategic Analysis

4.1 Economic Analysis

This section of the analysis will detail the economic climate, the investment management industry, the customer profile, and the competition that the business will face as it progresses through its business operations.

Currently, the economic condition as a result of the COVID-19 pandemic is rapidly improving. Interest rates have remained low, which has led to substantial improvement in the economy. Although there are issues with inflation, the US Federal Reserve has indicated that they are willing to adjust monetary policy to combat this issue. The economy is moving back towards normal at this time.

However, given the strategies that the Hedge Fund will employ for its trading operations – the Company will be able to remain profitable and cash flow positive at all times.

4.2 Industry Analysis

Within the United States, there are 20,000 companies that operate hedge fund, venture capital funds, and private equity funds. Each year, over $200 billion of revenue is generated among these businesses. The industry employs 60,000+ people.

This is a mature industry, and the future expected growth rate will mirror that of the economy as a whole. As discussed above, one of the best aspects of operating a Hedge Fund is that these entities can produce income in any economic climate through a number of market mechanisms.

4.3 Customer Profile

Hedge Funds have a very limited scope of people to which they can market their investment portfolio. This is especially true for the Hedge Fund as the Company will use marketable securities as its primary method of its day to day revenue generating activities.

Among people that the Company will solicit for investment, Management has identified the following demographic profile:

- Income of at least $500,000

- Average net worth of $3,000,000

- Is a bank, trust, or other private equity organization with at least $5,000,000 of assets.

Unfortunately, this business (for its investors) caters only to high net worth individuals that have an aggregate income of over $200,000 (if single) or $300,000 (if the client is married) or a net worth of at least one million dollars. Strict regulatory oversights prevent the Company from marketing the hedge fund to anyone that is not considered an accredited investor. These regulations may become more stringent as the Securities and Exchange Commission moves to have greater regulatory oversight over the hedge fund industry.

4.4 Competitive Analysis

As the investment advisory and hedge fund industries have grown, so has the level of competition. One of the drawbacks to the industry is that there are very low barriers to entry. Any individual or business may register itself as an investment advisor after completing the proper examinations and filings. The expected costs to build an investment advisory are low as it is a service oriented business. There are more than 8,000 other private investment groups that operate in a similar capacity.

5.0 Marketing Plan

The Hedge Fund intends to maintain an extensive marketing campaign that will ensure maximum visibility for the business in its targeted market. Below is an overview of the marketing strategies and objectives of the Hedge Fund.

5.1 Marketing Objectives

- Develop an online presence by developing a website and placing the Company’s name and contact information with online directories.

- Establish relationships with other investment advisories within the United States.

- Develop relationships with securities dealers that will sell partnerships within the Hedge Fund.

5.2 Marketing Strategies

As the Company cannot directly market its services to the general public, the Hedge Fund will hire a capital introduction firm to showcase the operations of the business to potential investors. These firms, for a commission, will introduce potential investors and investment groups to Management. These companies maintain extensive lists of accredited investors and institutions that frequently make investments into private investment companies.

The Hedge Fund will also develop a website specifically for investors that have registered or have become clients with the Company. This website will showcase the strategies that the Company uses, relevant contact information, and for registered inventors – information specifically related to their account.

Mr. Doe will also make presentations at popular hedge fund conventions while concurrently obtaining speaking engagements among other investment meetings so that his visibility and that of the firm increase over time.

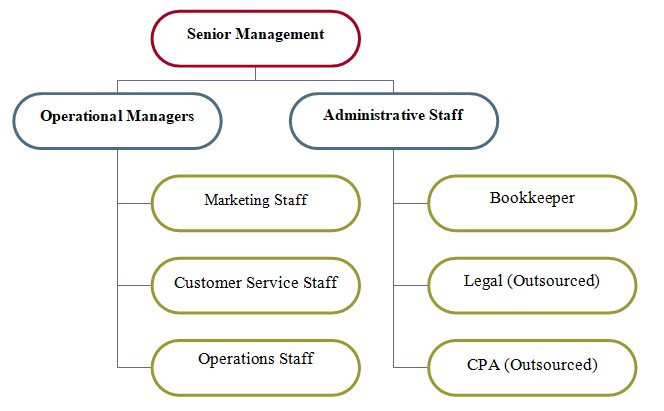

6.0 Organizational Overview

6.1 Organizational Chart

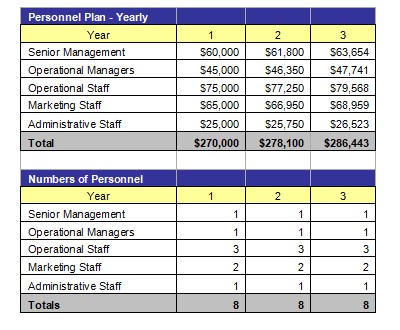

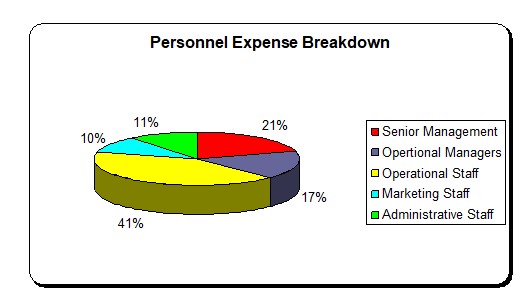

6.2 Personnel Budget

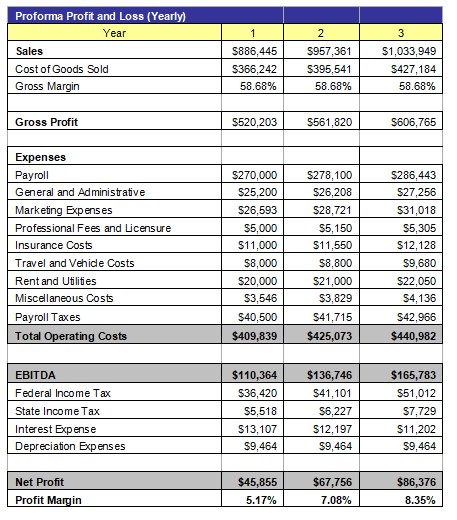

7.0 Financial Plan

7.1 Underlying Assumptions

The Company has based its proforma financial statements on the following:

- The Hedge Fund will have an annual revenue growth rate of 16% per year.

- The Owner will acquire $10,000,000 of equity funds to develop the business.

- The Company will earn a compounded annual return of 30% on its investment portfolio.

7.2 Sensitivity Analysis

It is the goal of the Company to make investments in economically viable companies that will produce dividend income, interest income, and capital appreciation. During times of economic recession, the Company’s portfolio may have issues with profit generation, which in turn, could lead to lower ROI’s on the Hedge Fund’s portfolio. However, the Company intends to use a number of investment strategies that will ensure that the firm will produce profits regardless of the general economic climate.

7.3 Source of Funds

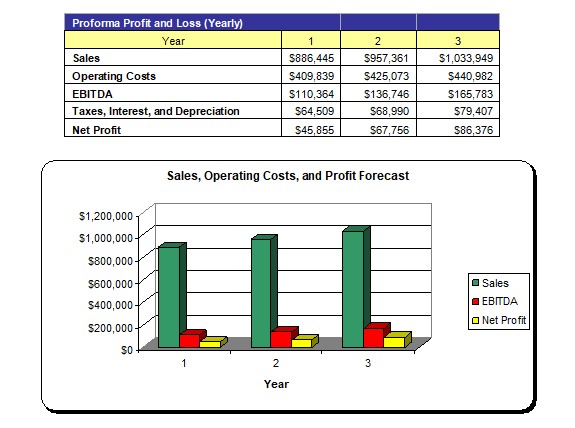

7.4 Profit and Loss Statement

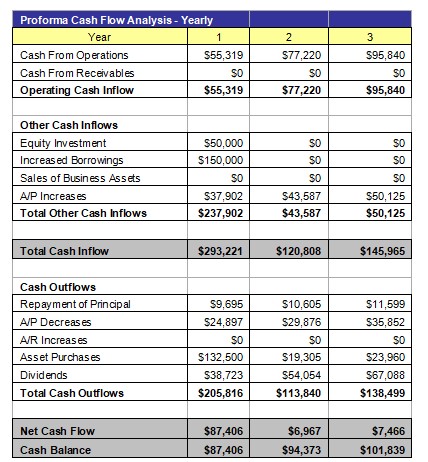

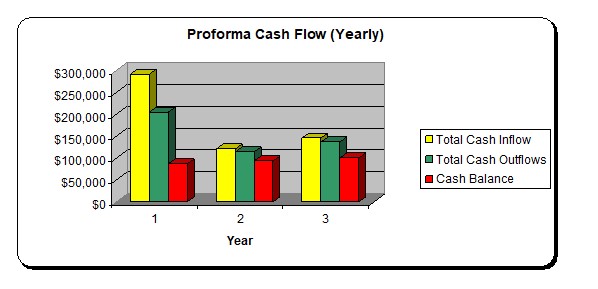

7.5 Cash Flow Analysis

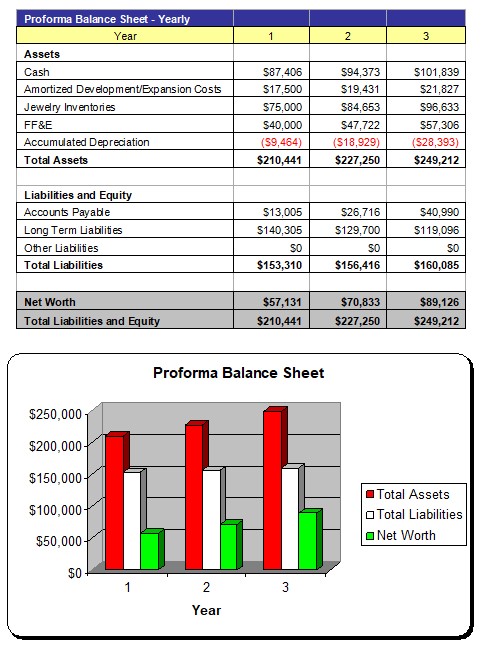

7.6 Balance Sheet

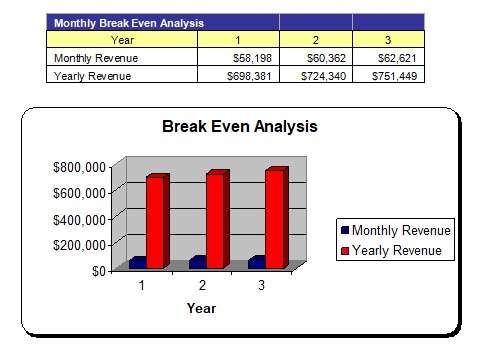

7.7 Breakeven Analysis

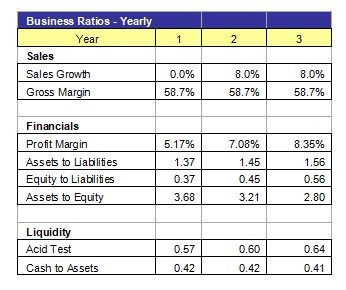

7.8 Business Ratios