Commercial Bank Business Plan, Marketing Plan, How To Guide, and Funding Directory

The Commercial Bank Business Plan and Business Development toolkit features 18 different documents that you can use for capital raising or general business planning purposes. Our product line also features comprehensive information regarding to how to start a Commercial Bank business. All business planning packages come with easy-to-use instructions so that you can reduce the time needed to create a professional business plan and presentation.

Your Business Planning Package will be immediately emailed to you after you make your purchase.

Product Specifications (please see images below):

- Bank/Investor Ready!

- Complete Industry Research

- 3 Year Excel Financial Model

- Business Plan (26 to 30 pages)

- Loan Amortization and ROI Tools

- Three SWOT Analysis Templates

- Easy to Use Instructions

- All Documents Delivered in Word, Excel, and PDF Format

- Meets SBA Requirements

Commercial banks are one of the oldest industries within the United States. In fact, commercial banking is one of the backbones to the economy. These organizations allow individuals to safely keep their money in a financial institution while concurrently being able to borrow funds to purchase new homes, develop new businesses, and pay for certain day-to-day expenses. In fact, one of the reasons why the commercial banking industry is the most regulated aspect of the financial system given that it is so central to every other business within the United States and abroad. The financial crisis of 2008 made it even abundantly more clear that having strong commercial regulations as it relates to banking is essential for a thriving economy.

Commercial banks are also an important part of any community given that they extend credit for economically viable projects like small businesses, farms, real estate developments, as well as a host of other financing activities that improve the lives of people within the community. In fact, many economic studies point to the fact that the extension of credit is one of the single greatest factors in ensuring that a community can thrive on an ongoing basis. This is especially true given that credit is the lifeblood for many small businesses that need ongoing working capital as well as expansion capital.

The barriers to entry for a new commercial bank are extremely high. Typically, a minimum capital investment of at least $10 million to $20 million is required as part of the tier 1 capital needed to launch operations. Banks typically are able to lend up to 90% of the money that they have in deposits, but they are required to keep a substantial amount of equity on hand in order to defray some of the risks that may happen with credit defaults. Generally, a commercial bank cannot be owned by one single individual. It is a requirement by the FDIC as well as the US Federal Reserve system that a large-scale board of directors is maintained in order to properly carry out banking operations.

A commercial bank business plan should have a three-year profit and loss statement, cash flow analysis, balance sheet, breakeven analysis, and business ratios page it focuses significantly on how income will be generated from interest on loans as well as fees associated with checking accounts, savings accounts, and brokerage accounts. It is been one of the common trends within this industry to integrate a host of financial services into one commercial banking facility. In fact, among the 8,000 different banks within the United States about half of them maintain securities licenses so they can hold individuals retirement accounts, 401(k)s, IRAs, and related financial instruments on behalf of their customers. This trend is expected to continue in perpetuity given that vertical integration allows for commercial banks to generate significantly more profits.

The commercial bank business plan should also feature a substantial amount of demographic information. This is going to be required by the Federal Reserve as well as other banking organizations are issue licenses before operations can commence. This examination should include an overview of the population size, population density, median household income, median family income, median household value, and the demographics of people of all ages. Anyone that is over the age of 18 can acquire a bank account and it is important to understand the wealth and income levels within the target market in order to get an understanding of how much money will be held in deposits at any given time. These again are going to be pieces of information that are to be required not only in the business plan but also for applications for banking licenses.

A commercial bank marketing plan is also going to need to be developed and submitted not only to investors that are going to put up the initial $10 to $20 million of capital needed but also to licensing authorities. Foremost, most commercial banks start in more rural areas were small towns in order to get an initial customer base. Many people choose to do banking with smaller banks because they prefer the close personal relationship that they can have with their financial professionals. As such, most commercial banks position their marketing messages so that they are able to effectively differentiate themselves from large-scale money center banks. Although commercial banks are operate in a different capacity than a credit union, most local small banks do try to provide the same level of service. It is imperative

It is imperative these days that any financial institution maintain an expansive online presence as it relates to not only providing information about services offered but also functionality that allows the users to check their online balances, complete bill paying, overview any loans or lines of credit there are outstanding, and a whole host of other activities that are normally associated with financial transactions. This is now no longer an option for a business to have given that almost all large money center banks to provide their customers not only with a website they can use for financial transactions but also for mobile applications as well. Once established, many smaller commercial banks will seek to develop mobile applications that allow users to manage their finances from the convenience of their mobile phone or tablet.

A large-scale print advertising campaign is going to need to be undertaken in order to generate interest among individuals within the community for checking accounts, savings accounts, and brokerage accounts. Most importantly, this print advertising campaign needs to be carry out on every medium available within a target market radius of 25 miles to 50 miles depending on the type of location. An attorney that is familiar with banking and lending laws should review all marketing materials that are distributed by the bank in order to ensure that the business is complying with all disclosure laws at all times. This is one of the major ongoing challenges for marketing as it relates to a commercial bank given that certain statements must fall in line with legally permissible regulations.

A commercial bank SWOT analysis should be produced as well. As it relates to strengths, a commercial bank is able to generate income and pretty much every economic climate given that loans are considered to be contractual agreements and interest will continue to be paid despite whether or not the economy is doing well or poorly. Additionally, commercial banks have extremely high barriers to entry given the extremely large amount of money needed to launch operations as well as the ongoing licensing activities that need to be maintained at all times. For weaknesses, commercial banks can have a decline in the revenues or have substantial issues with the balance sheets during times of economic recession when people do not pay their financial obligations. However, most financial institutions are highly regulated so that if a loss occurs in any given time the bank will be able to remain financially stable. For opportunities, one of the ways that has been most prevalent for commercial banks to expand their operations is to acquire third-party companies. These mergers and acquisitions often create much larger financial situations are far more financially stable. Additionally, many commercial banks will seek to sell themselves to a large money center bank in order to generate a substantial return on investment from the sale of the business as a whole. Many financial institutions will also seek to establish additional locations so that they can even increase the number of deposits that they have in the form of checking accounts and savings accounts. Finally, for threats – major changes in regulation are frequent within the financial services and commercial banking industry. As such, a highly skilled attorney or law firm has extensive familiarity with commercial banking needs to be retained in order to ensure that the bank can properly operate due to any changes in financial regulation on the federal level.

A commercial bank is one of the hardest types of businesses to start but once they are operational there tend to be highly profitable companies. It is imperative that the entrepreneur that is looking to start this business have an extensive understanding of banking as well as extensive experience within this field. Banking licenses required that there is a significant amount of experience and diligence as it rates to operating these businesses on a day-to-day basis.

Commercial Bank Business Plan

1.0 Executive Summary

The purpose of this business plan is to raise $10,000,000 for the development of a commercial bank while showcasing the expected financials and operations over the next three years. Commercial Bank, Inc. (“the Company”) is a New York based corporation that will provide traditional commercial banking services for its investors in its targeted market. The Company was founded by John Doe.

1.1 The Operations

As stated above, the Company will act in a traditional banking capacity by offering loans, checking accounts, savings accounts, and other financial products normally associated with banks. At this time, Mr. Doe is securing the capital that is required in order to receive a banking license from the US Federal Reserve. The Founder is also undergoing the process of acquiring the needed licensure to operate this business.

The third section of the business plan will further describe the underwriting services and investment management services offered by the Commercial Bank.

1.2 The Financing

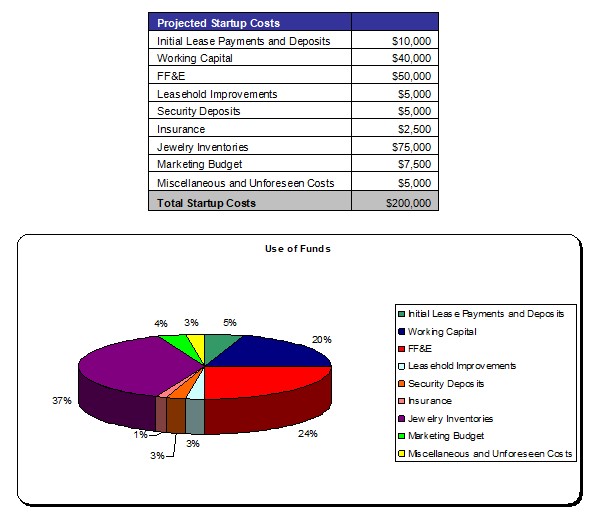

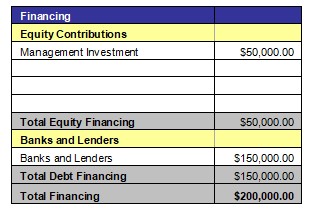

At this time, the Company is seeking to raise $10,000,000 for the development of the Commercial Bank’s operations. Mr. Doe is seeking to sell an 80% ownership interest in the business in exchange for this capital. 85% of the invested capital will be used for direct investments into the firm’s investments. Briefly, the capital will be used as follows:

- Financing for lending activities.

- Development of the Company’s initial branch.

- General working capital.

1.3 Mission Statement

Management’s mission is to provide the greater New York metropolitan area with an extensive line of banking and financial services that are affordable and convenient.

1.4 Management Team

The Company was founded by John Doe. Mr. Doe has more than 10 years of experience in the commercial banking industry. Through his expertise, he will be able to bring the operations of the business to profitability within its first year of operations.

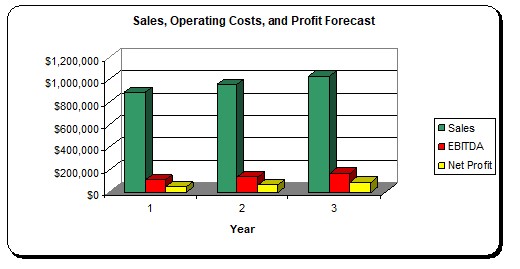

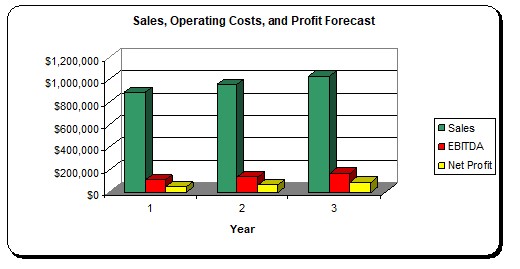

1.5 Revenue Forecasts

1.6 Expansion Plan

The Company plans on positioning itself toward becoming a leading financial services provider among middle income people. As time continues, Commercial Bank, Inc. intends to not only expand its geographic reach by establishing relationships and offices in other major metropolitan areas but also by acquiring banks.

2.0 The Financing

2.1 Registered Name and Corporate Structure

Commercial Bank, Inc. The Company is registered as a corporation in the State of New York.

2.2 Use of Funds

2.3 Investor Equity

At this time, Mr. Doe is seeking to sell an 80% interest in the Commercial Bank in exchange for the capital sought in this business plan. Please reference the Company’s private placement memorandum regarding more information regarding the Company’s fee and ownership structure.

2.4 Management Equity

John Doe currently owns 100% of the Commercial Bank, Inc.

2.5 Exit Strategy

The Management has planned for three possible exit strategies. The first strategy would be to sell the Company to a larger entity at a significant premium. Since, the financial management and commercial banking industry maintains a very low risk profile once the business is established; the Management feels that the Company could be sold for ten to fifteen times earnings.

The second exit scenario would entail selling a portion of the Company via an initial public offering (or “IPO”). After a detailed analysis, it was found that the Company could sell for twenty to thirty times earnings on the open market depending on the business’s annual growth rate and strength of earnings. However, taking a company public involves significant legal red tape. Commercial Bank, Inc. would be bound by the significant legal framework of the Sarbanes-Oxley Act in addition to the legal requirements set forth in form S1 of the Securities and Exchange Commission. The Company would also have to comply with the Securities Act of 1933 and the Exchange Act of 1934.

3.0 Operations

Below is a description of the commercial banking services offered by the Company.

3.1 Customer Accounts

The primary service offered by Commercial Bank, Inc. is the management of checking accounts, savings accounts, and money market accounts. The bank, in turn, will use these deposits for financing customer loans and for making acquisitions of debt instruments in the secondary markets. The Company will provide Visa/MasterCard branded debit cards that can be used in any ATM or at stores that accept EBT payments.

At all times, the Company will comply with the myriad of federal, state, and central bank regulations (specifically Regulation U) that guide the operations of thrifts, trusts, and financial companies.

3.2 Loans

Through its branches, the business will be able to provide its customers with a variety of lending products including:

- First time homebuyer mortgages

- Second mortgages

- Home equity lines of credit/loans

- Commercial Mortgages

- Mortgage refinancing

- Automotive Loans

- Marine Loans

- Business Loans (SBA and traditional commercial loans)

- Student Loans

- Debt Consolidation

- Credit Cards (Secured, Unsecured, and Prepaid Cards)

4.0 Market and Strategic Analysis

4.1 Economic Analysis

This section of the analysis will detail the economic climate, the banking industry, the customer profile, and the competition that the business will face as it progresses through its business operations.

Currently, the economic climate is uncertain. The pandemic stemming from Covid-19 has created a substantial amount of turmoil within the capital markets. It is expected that a prolonged economic recovery will occur given that numerous businesses are being forced to remain closed for an indefinite period of time (while concurrently having their respective employees remain at home). However, central banks around the world have taken aggressive steps in order to ensure the free flow of capital into financial institutions. This is expected to greatly blunt the economic issues that will arise from this public health matter.

4.2 Industry Analysis

In the United States there are over 75,000 businesses that operate as depository credit institutions. Among these business, aggregates receipts over each of the last five years has been in excess of $800 billion dollars of interest and service revenue. These businesses employ over 1.7 million people.

This is a mature industry, and the future growth rate will mirror that of the economy as a whole. One of the major trends within this industry is for commercial banks to engage in a wide range of businesses including traditional banking coupled with brokerage/investment banking services. Moving forward, the Company may seek to integrate these operations into the overall service architecture of the business.

4.3 Customer Profile

The Company has established several lending procedures that will ensure that the Company’s default rate is less than 1.5% of the Company’s total loan portfolio. Among people that will use the Company’s services for borrowing money, Management has developed the following demographic profile:

- Between the ages of 28 and 65

- Household income of $35,000+

- Will borrow for an automotive or home purchase.

- Lives within 10 miles of a Commercial Bank branch

4.4 Competitive Analysis

This is one of the sections of the business plan that you must write completely on your own. The key to writing a strong competitive analysis is that you do your research on the local competition. Find out who your competitors are by searching online directories and searching in your local Yellow Pages. If there are a number of competitors in the same industry (meaning that it is not feasible to describe each one) then showcase the number of businesses that compete with you, and why your business will provide customers with service/products that are of better quality or less expensive than your competition.

5.0 Marketing Plan

Commercial Bank, Inc. intends to maintain an extensive marketing campaign that will ensure maximum visibility for the business in its targeted market. Below is an overview of the marketing strategies and objectives of the Commercial Bank.

5.1 Marketing Objectives

- Develop an online presence by developing a website and placing the Company’s name and contact information with online directories.

- Establish relationships with third party banks within the United States (for specialized syndications).

- Maintain an expansive presence among all social media platforms.

- Maintain strong relationships with regional community organizations.

5.2 Marketing Strategies

Management intends to use a number of marketing strategies to immediate generate depositors and borrowers for Commercial Bank, Inc. The Company intends to use traditional print and media advertising as well as online sales tactics which will further increase visibility of Commercial Bank.

The Company will maintain an expansive presence on the internet. The business’ website will feature integrated banking functionality so that customers can engage all of their banking needs from the platform. The website will be mobile friendly and search engine optimized. The Company will have a stand along application developed that compliments the Company’s website.

The Commercial Bank will also maintain pages among all major social media platforms including Facebook, Twitter, Instagram, LinkedIn, and related platforms. The business will use targeted advertisements on these platforms among people that live within the target market area and fall into the Company’s demographic profile.

The business will regularly distribute a number of flyers while concurrently engaging in a massive grand opening in order to inform potential depositors and borrowers of the Company’s banking operations. The grand opening period will last three to six months depending on the success of the marketing campaign. Additionally, higher interest rates and lower loan rates will be used in order to convince people to switch their checking accounts and loan needs to Commercial Bank, Inc.

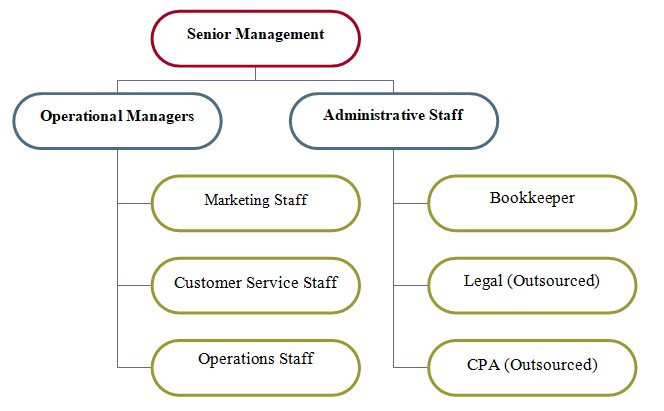

6.0 Organizational Overview

6.1 Organizational Chart

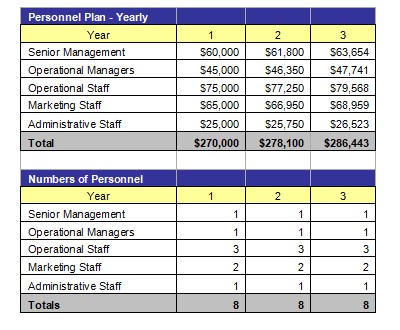

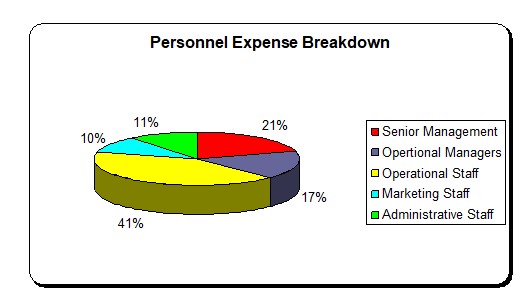

6.2 Personnel Budget

7.0 Financial Plan

7.1 Underlying Assumptions

The Company has based its proforma financial statements on the following:

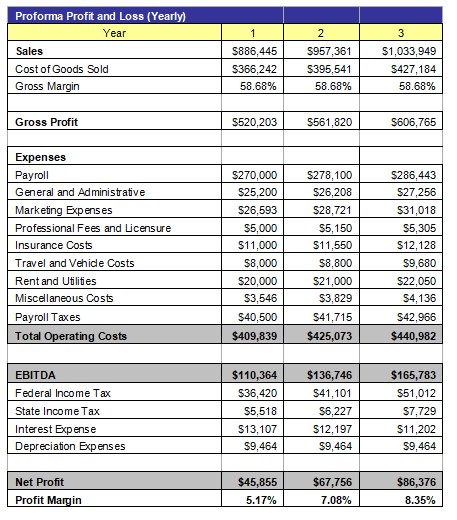

- Commercial Bank will have an annual revenue growth rate of 20% per year.

- The Owner will acquire $10,000,000 of equity funds to develop the business.

- The Company will earn a compounded annual return of 30% on its proprietary investment portfolio.

7.2 Financial Highlights

The Company’s revenues are sensitive to the overall condition of the financial markets. Revenues derived from the lending portfolio are directly tied to the prevailing prime credit interest rate. As such, the Company must strive to invest in high credit quality investments that have ‘staying power’ during times of economic recession or pullback. Management will enact stringent credit control and screening policies to ensure that losses resulting from defaulted loans are kept below 1.5% of the Company’s closed loan portfolio.

7.3 Source of Funds

7.4 Profit and Loss Statement

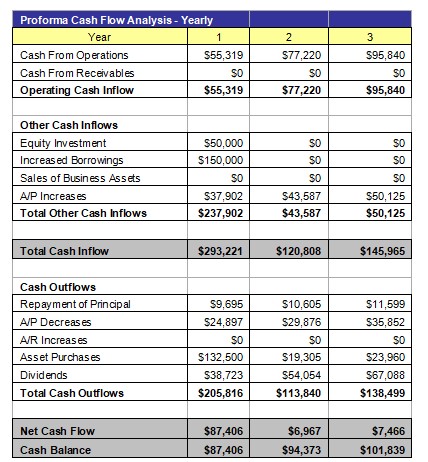

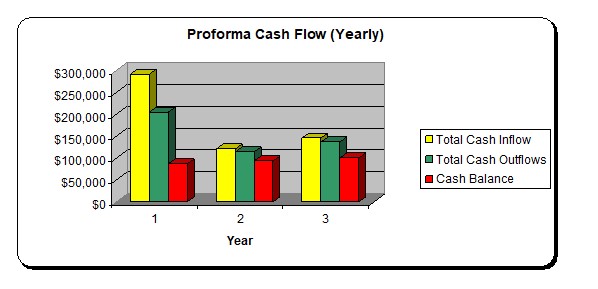

7.5 Cash Flow Analysis

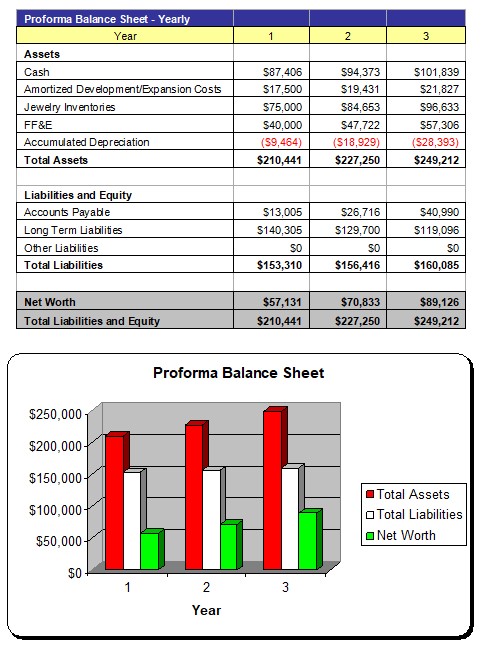

7.6 Balance Sheet

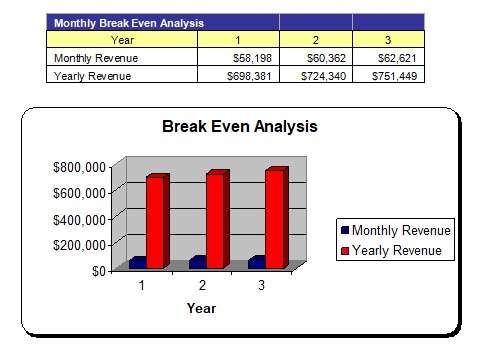

7.7 Breakeven Analysis

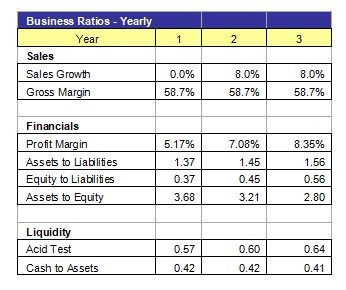

7.8 Business Ratios