Accounting Firm Business Plan, Marketing Plan, How To Guide, and Funding Directory

The Accounting Firm Business Plan and Business Development toolkit features 18 different documents that you can use for capital raising or general business planning purposes. Our product line also features comprehensive information regarding to how to start a Accounting Firm business. All business planning packages come with easy-to-use instructions so that you can reduce the time needed to create a professional business plan and presentation.

Your Business Planning Package will be immediately emailed to you after you make your purchase.

Product Specifications (please see images below):

- Bank/Investor Ready!

- Complete Industry Research

- 3 Year Excel Financial Model

- Business Plan (26 to 30 pages)

- Loan Amortization and ROI Tools

- Three SWOT Analysis Templates

- Easy to Use Instructions

- All Documents Delivered in Word, Excel, and PDF Format

- Meets SBA Requirements

One of the best aspects to operating an accounting firm (especially among those that carry the CPA designation) is that these services are in demand in any economic climate. This is one of the primary strengths of these businesses given that many people cannot do their own taxes. This is especially true among small businesses that need ongoing tax and consulting support from their accountants. It is imperative to have a well developed business plan prior to launching a new accounting firm. The startup costs for a new accounting firm are usually in the $20,000 to $50,000 range depending on the location, staffing requirements, and the type of work provided by the accountant. There are many opportunities for an accountant to grow their business including by offering financial planning advice and wealth management services. Banks and financial institutions generally are very receptive to providing startup loans and lines of credit to accounting firms given the highly predictable and highly recurring streams of revenue generated by these businesses. In regards to generating recurring streams of revenue, many accounting firms provide payroll and bookkeeping services. For newer accounting firms, these revenues are extremely important as they ensure profitability very quickly.

A marketing plan should also be developed when a person is developing a new accounting firm or CPA firm. Given that there is a substantial amount of competition among local accountants, it is imperative that a marketing plan that differentiates the firm from other companies is provided. Many accountants differ their firms by, again, providing financial advice, offering audit insurance, and providing small business consulting services. By offering more services, individuals and small business owners can view the firm as a one-stop-shop for all of their accounting and financial planning needs.

Once a business plan and marketing plan is developed, it is important to develop a SWOT analysis as well in order to determine all of the issues that the business will face as it progresses through its operations.

The gross margins achieved from accounting services is extremely high. As this is a service business, the primary costs incurred are related to collecting payment (via credit card). Bad debt expense is also one of the primary considerations that must be dealt with when developing an accounting firm business plan. As acceptance of credit/debit cards has become ubiquitous, there is a need for all businesses to accept this form of payment. This can substantially reduce bad debt issues that are common with professional service businesses.

The demand for accounting services will remain strong moving forward. Given the complexities of the tax code, it is unlikely that automation will have a substantial impact on an accounting firm’s ability to operate. While simpler tasks such as bookkeeping may become automated over time, interpretation of the tax code needs a person.

As it relates to growth, many accounting firms expand by hiring associates that can render services on behalf of the business. Another methodology of growth is to acquire existing firm that are already in profitable operation. It is very easy to acquire the capital necessary to acquire an in operation business.

1.0 Executive Summary

The purpose of this business plan is to raise $150,000 for the development of an accounting firm while showcasing the expected financials and operations over the next three years. The Accounting Firm, Inc. (“the Company”) is a New York based corporation that will provide accounting, consulting, and tax services to customers in its targeted market. The Company was founded by John Doe.

1.1 The Services

The Accounting Firm will provide accounting services such as bookkeeping, tax preparation, and consulting to individuals and small businesses. The Company will earn a substantial amount of revenue during the tax season from filing tax returns from individuals and businesses within the target market. Mr. Doe will hire an associate CPA and a bookkeeper to assist with running the day to day operations of the business.

During tax season, the Company will hire 3 tax preparers.

The third section of the business plan will further describe the services offered by the Accounting Firm.

1.2 The Financing

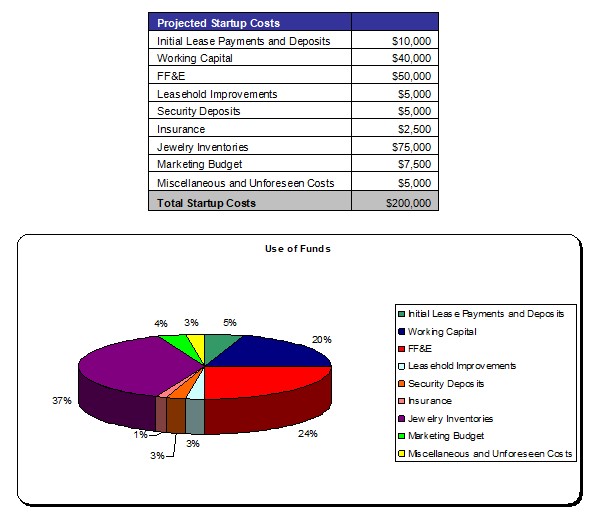

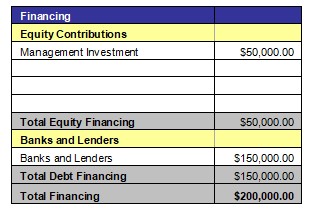

Mr. Doe is seeking to raise $150,000 from as a bank loan. The interest rate and loan agreement are to be further discussed during negotiation. This business plan assumes that the business will receive a 10 year loan with a 9% fixed interest rate. The financing will be used for the following:

- Development of the Company’s office.

- Financing for the first six months of operation.

- Capital to purchase a company vehicle.

Mr. Doe will contribute $25,000 to the venture.

1.3 Mission Statement

The Accounting Firm’s mission is to become the recognized leader in its targeted market for accounting services.

1.4 Management Team

The Company was founded by John Doe. Mr. Doe has more than 10 years of experience in the accounting industry. Through his expertise, he will be able to bring the operations of the business to profitability within its first year of operations.

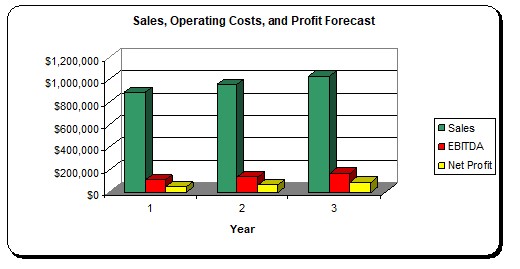

1.5 Revenue Forecasts

1.6 Expansion Plan

The Founder expects that the business will aggressively expand during the first three years of operation. Mr. Doe intends to implement marketing campaigns that will effectively target small businesses and individuals within the target market.

2.0 The Financing

2.1 Registered Name and Corporate Structure

Accounting Firm, Inc. The Company is registered as a corporation in the State of New York.

2.2 Use of Funds

2.3 Investor Equity

Mr. Doe is not seeking an investment from a third party at this time.

2.4 Management Equity

John Doe owns 100% of the Accounting Firm, Inc.

2.5 Exit Strategy

If the Accounting is very successful, Mr. Doe may seek to sell the business to a third party for a significant earnings multiple. Most likely, the Company will hire a qualified business broker to sell the business on behalf of the Accounting Firm. Based on historical numbers, the business could fetch a sales premium of up to 4 times earnings.

3.0 Operations

Below is a description of the tax and accounting services offered by the Accounting Firm.

3.1 Accounting and Consulting Services

The primary source of income for the Accounting Firm is accounting services that will be provided to the general public. This section of the business will provide bookkeeping to individuals and small businesses within the target market. Each month, the Company will bill a client on a per hour basis. Expected hourly fees for bookkeeping will be $20 to $40 per hour based on the complexity of the work.

Mr. Doe, a licensed CPA, will also provide consulting advice directly to clients for $100 per hour.

3.2 Tax Services

Seasonally, the Accounting Firm will make a substantial amount of money for filing tax returns for businesses. Each tax return will generate $300 to $1,000 depending on the complexity and the amount of paperwork to file.

4.0 Market and Strategic Analysis

4.1 Economic Analysis

This section of the analysis will detail the economic climate, the accounting industry, the customer profile, and the competition that the business will face as it progresses through its business operations.

Currently, the economic climate is uncertain. The pandemic stemming from Covid-19 has created a substantial amount of turmoil within the capital markets. It is expected that a prolonged economic recovery will occur given that numerous businesses are being forced to remain closed for an indefinite period of time (while concurrently having their respective employees remain at home). However, central banks around the world have taken aggressive steps in order to ensure the free flow of capital into financial institutions. This is expected to greatly blunt the economic issues that will arise from this public health matter. However, accounting firms are generally immune from changes in the economy as most people cannot effectively file their own tax returns.

4.2 Industry Analysis

The accounting industry is a highly fragmented group of individual practitioners, small firms, and large auditing institution. There are over 621,000 accountants in the United States. The industry generates over $38 billion dollars a year, and employs over 390,000 Americans.

The demand for accounting services is expected to increase as the number of businesses and the complication of tax issues increase. With the advent of the Sarbanes-Oxley Act, businesses that have passive investors must comply with the myriad of laws stated throughout the Act.

4.3 Customer Profile

The Accounting Firm’s average client will be middle to upper middle income earners or a small to medium size business. The clients will seek professional advice to help them solve their accounting and tax issues. Common traits among clients will include:

- Annual household income exceeding $50,000

- Owns a small business or is involved in a profession

- Lives or works no more than 15 miles from the Company’s location.

- Will spend $100 to $1,000 with the Accounting Firm

4.4 Competitive Analysis

This is one of the sections of the business plan that you must write completely on your own. The key to writing a strong competitive analysis is that you do your research on the local competition. Find out who your competitors are by searching online directories. If there are a number of competitors in the same industry (meaning that it is not feasible to describe each one) then showcase the number of businesses that compete with you, and why your business will provide customers with service/products that are of better quality or less expensive than your competition.

5.0 Marketing Plan

The Accounting Firm intends to maintain an extensive marketing campaign that will ensure maximum visibility for the business in its targeted market. Below is an overview of the marketing strategies and objectives of the Accounting Firm.

5.1 Marketing Objectives

- Develop an online presence by developing a website and placing the Company’s name and contact information with online directories.

- Implement a local campaign with the Company’s targeted market via the use of flyers, local newspaper advertisements, and word of mouth advertising.

- Establish relationships with attorneys and accountants within the targeted market.

5.2 Marketing Strategies

Mr. Doe intends on using a number of marketing strategies that will allow the Accounting Firm to easily target small businesses and individuals within the target market. These strategies include traditional print advertisements and ads placed on search engines on the Internet. Below is a description of how the business intends to market its services to the general public.

The Accounting Firm will also use an internet based strategy. This is very important as many people seeking local services, such as accountants, now the Internet to conduct their preliminary searches. Mr. Doe will register the Accounting Firm with online portals so that potential customers can easily reach the Accounting firm. The Company will also develop its own online website.

The Company will maintain a sizable amount of print and traditional advertising methods within local markets to promote the accounting services that the Company is selling.

5.3 Pricing

For bookkeeping services the Company will charge $20 to $40 per hour depending on the complexity of the bookkeeping work. Mr. Doe will charge clients $100 per hour for providing tax advice and consulting services to the general public.

6.0 Organizational Overview

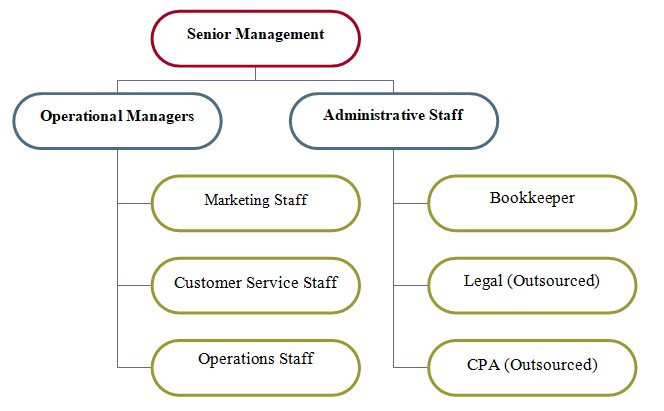

6.1 Organizational Chart

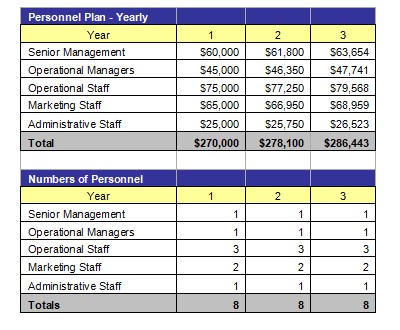

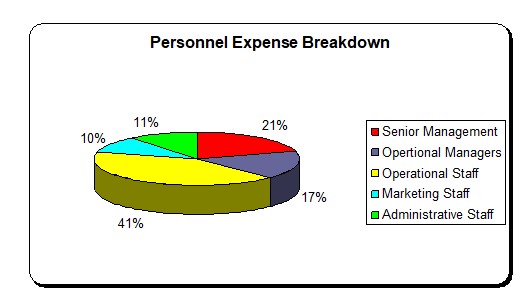

6.2 Personnel Budget

7.0 Financial Plan

7.1 Underlying Assumptions

The Company has based its proforma financial statements on the following:

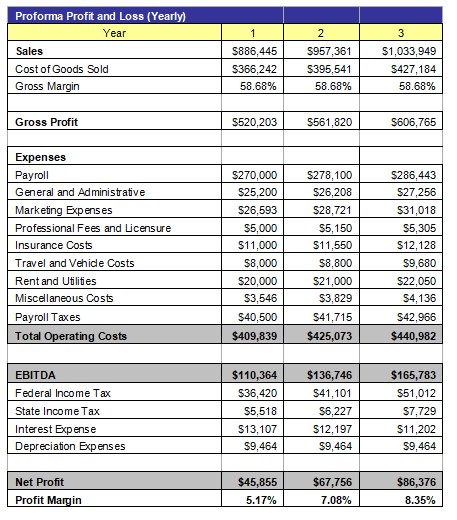

- The Accounting Firm will have an annual revenue growth rate of 9% per year.

- The Owner will acquire $150,000 of debt funds to develop the business.

- The loan will have a 10 year term with a 5% interest rate.

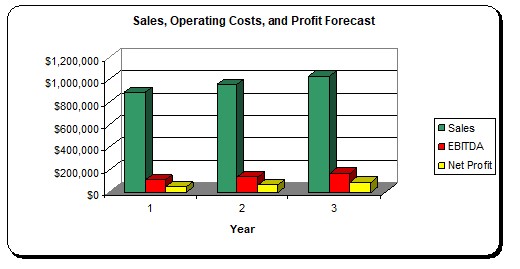

7.2 Financial Highlights

In the event of an economic downturn, the business may have a decline in its revenues. However, accounting services are demanded by businesses and individuals due to the complexity of completing tax forms. As such, only a severe economic downturn would result in a decline in revenues.

7.3 Source of Funds

7.4 Profit and Loss Statement

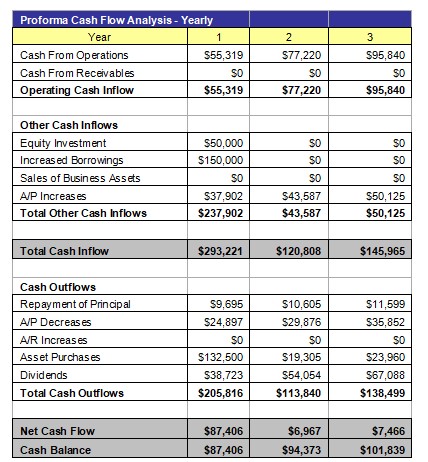

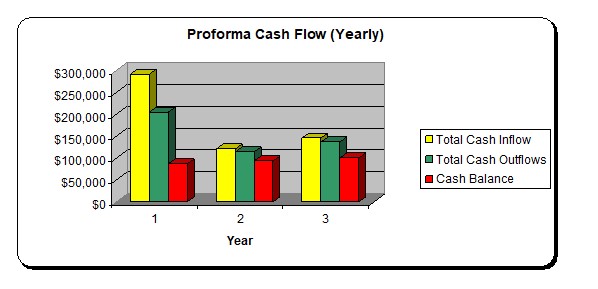

7.5 Cash Flow Analysis

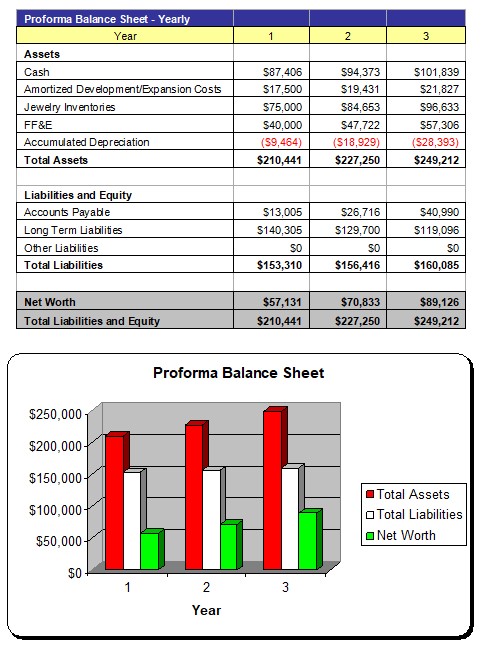

7.6 Balance Sheet

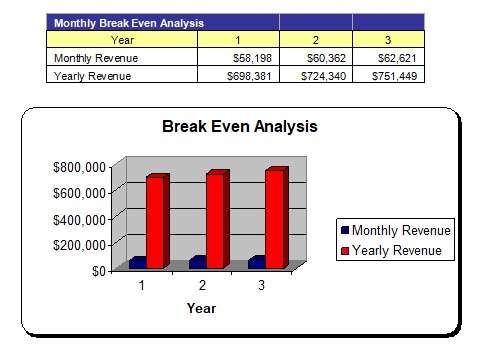

7.7 Breakeven Analysis

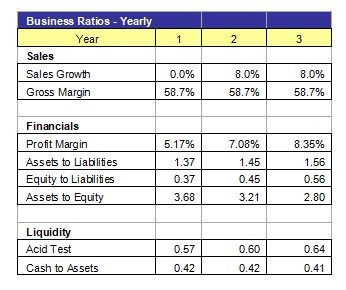

7.8 Business Ratios